Written by Emily Cross.

17 minute read

When someone dies, you may be feeling lost and confused as to how to begin preparing for a funeral amidst your grief. Trying to figure out who is responsible for how much a funeral costs when a loved one dies is likely the last thing you want to think about, especially whilst you’re navigating the immediate stages of your loss and making the necessary funeral arrangements. For this reason, many families consider arranging funeral cover for parents ahead of time, to spare the next generation from financial stress when the inevitable happens.

In this article, we hope to help by providing some answers about who may be responsible for those costs.

For a deeper dive into whether being next of kin means you must pay, see our guide answering does next of kin have to pay for funeral – it provides further clarity on legal obligations.

Key takeaways:

When a loved one dies, navigating the practicalities of how to plan a funeral can be emotionally and financially overwhelming. What to do when someone dies is not something we are usually well prepared for. A big concern for many is determining who is responsible for covering the costs. The legalities surrounding funeral expenses are often misunderstood, leading to extra stress during a challenging time when family members may not know who legally has to pay for the funeral.

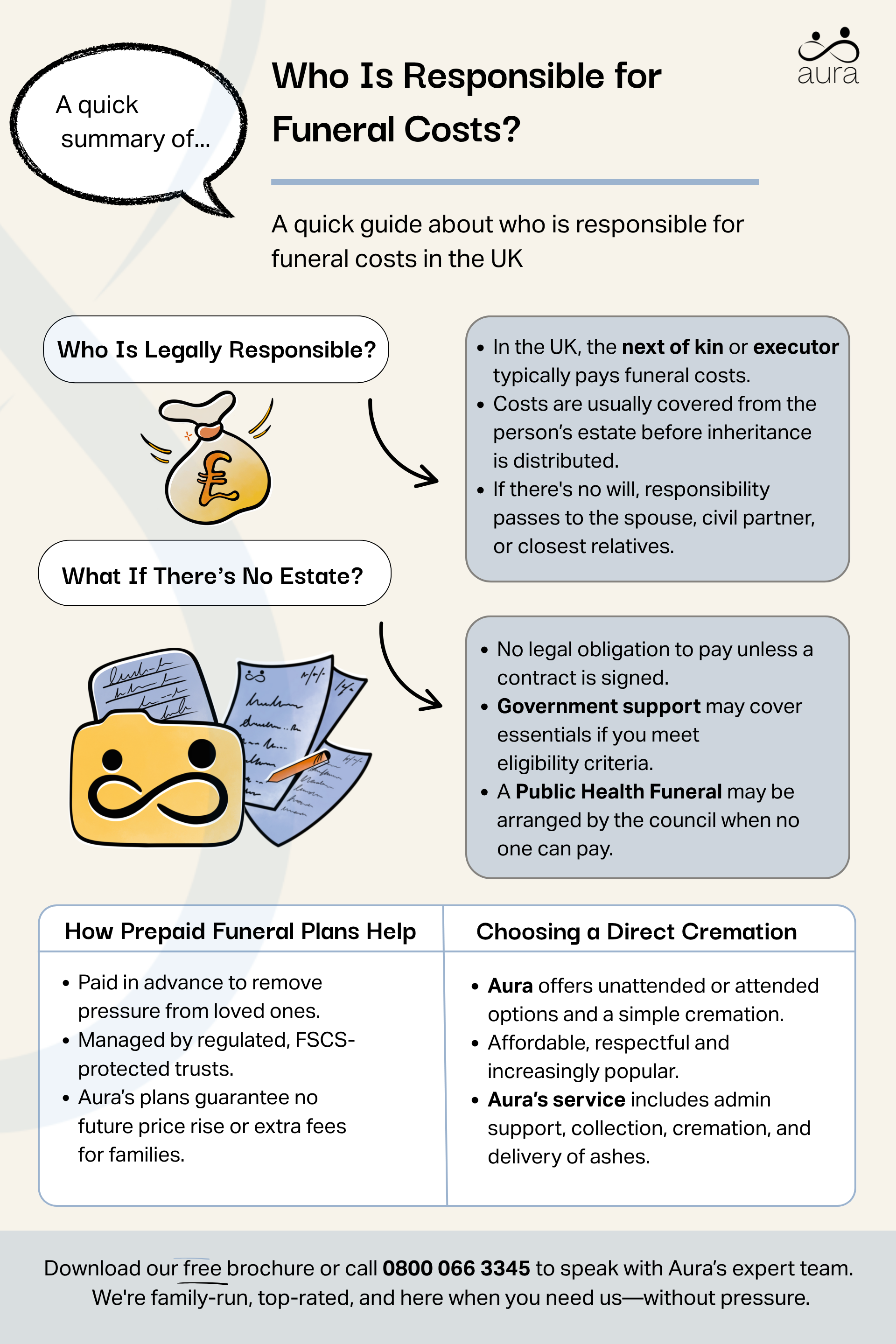

In the UK, unless the person who has died had purchased a prepaid funeral plan, the cost of a person’s funeral is usually settled with the money leftover from their estate. However, factors such as the existence of a will, the role of the executor, and the family’s willingness to contribute can also have an effect.

People often ask who legally has to pay for a funeral, or who is responsible for paying for a funeral. In the UK, the responsibility primarily lies with the executor of the will or the next of kin. Executors are tasked with managing the estate, which includes settling any outstanding debts, including funeral expenses. This is why it is important to know what to consider when choosing an executor, and making sure they know all that it entails.

When someone dies without a will, the duty of arranging a funeral often falls on the person’s spouse or civil partner. If they did not have a spouse or civil partner, the responsibility moves along to their children, then their parents, then their siblings, and so on.

One way to avoid difficulties and potential stress in arranging payment for a funeral is to purchase a prepaid funeral plan.

The primary purpose of a funeral plan is to ensure your funeral is paid for before you die, so that those closest to you don’t have to worry about organising and paying for an expensive funeral at an already difficult time. You will purchase your funeral plan from a funeral director – whether it is a local or national provider – who will securely hold your funds until required. When the time comes, your chosen provider will take care of all of your arrangements as per your wishes.

Aura is one such provider of prepaid direct cremation funeral plans. We offer a simple, low-cost alternative to a traditional funeral, and when comparing funeral plans, it’s easy to see why we have an ‘Excellent’ 4.9/5 stars on Trustpilot. Our dedicated team of Aura Angels is there to guide families through the process of arranging the funeral, and are experts in offering efficient and compassionate service. When a parent dies, they will be a listening presence and a dependable comfort for you and your family.

When you buy one of Aura’s plans, we place your money into our secure, FSCS-protected trust. That trust is independently managed, and it means your money is kept to the side, ready to be used when the time comes to put the plan in motion.

If you are the child or next of kin of someone who has died, we can access it in order to activate their plan when it’s needed to pay for everything.

Our plans are also protected by the Financial Services Compensation Scheme (FSCS). This reassures you that, in the highly unlikely scenario where Aura is not able to action the plan, you may be eligible for compensation. We are the only prepaid direct cremation plan provider on Fairer Finance with two 5-star-rated plans.

Funeral expenses are usually prioritised and paid from the estate of the person who has died, and executors are required to use estate funds to cover these costs before distributing inheritance money to beneficiaries. This process ensures the person’s final wishes are honoured while adhering to financial and legal rules.

If there is not enough money in the estate to pay for the funeral, executors could access money in the bank account of the person who has died by presenting a Death Certificate to the bank. Unfortunately, if funeral costs cannot be dealt with harmoniously, it can sometimes lead to legal disputes among beneficiaries.

It’s important to know that when someone dies, their assets, such as bank accounts and savings, are typically frozen until probate is granted. Probate is the legal process that confirms the will (if there is one) and gives the executor authority to access the estate. This process can take several weeks or even months. During this time, funds in the estate usually can’t be accessed, which can delay reimbursement for any expenses.

Because of this, the person who arranges the funeral is usually the one who pays for it upfront. This person enters into a contract with the funeral provider and becomes responsible for the initial payment. Later on, they can usually reclaim the funeral costs from the estate once funds become available.

This is often why the executor or next of kin ends up covering funeral costs in the first instance, even though the estate is ultimately responsible. Some banks may release funds directly to the funeral provider if shown an invoice and the death certificate, but this isn’t always guaranteed, and the process can vary.

Families often ask who pays for a funeral if there is no money. If there happens to be no estate or assets, the proceedings can become a little more complex. In situations like this, families may find themselves facing funeral poverty, where the cost of even a simple service creates financial strain during an already difficult time.

Fortunately, government support exists to help alleviate financial pressure for those who are eligible. This support offers assistance to those who qualify to receive certain benefits, covering essential costs like cremation.

When the estate cannot cover funeral costs, family members may feel they need to step in and help. However, no one is legally required to pay unless they have personally authorised funeral arrangements, or funeral cover for parents, for example.

In cases where no one is able or willing to pay, local authorities can provide a basic public health funeral, often called a ‘pauper’s funeral’. Public health funerals are sometimes confused with direct funerals, but are two different services.

While a public health funeral is provided by the government, direct funerals are chosen by a person or a family as their preferred service because of their simplicity, affordability and straightforward approach. By contrast, a public health or ‘pauper’s funeral’ is orchestrated by a local council who is legally required to make arrangements for someone who has died within their jurisdiction.

Direct funerals are becoming an increasingly popular choice for those who do not wish for more traditional funeral options, such as full cremation or burial services with hearses, limousines and lots of mourners in attendance. Direct cremation prices are also attractive to those who may find themselves with limited access to funds to cover funeral costs.

Aura provides direct cremations as a low-cost funeral option to families all across mainland Britain. We understand that cremation costs can be confusing, especially in times of grief. That’s why Aura sets out to offer clear, transparent services and all-inclusive plans, offering peace of mind for you and those closest to you..

Aura offers the highest quality care with a personal touch. We respond quickly and compassionately, ensuring that the person who has died is collected within 72 hours, with attentive support every step of the way. This goes for whether the person who has died has purchased a prepaid plan, or there is a need for assistance right away.

We bring the person who has died to one of our local care centres from where they died. Then, when it’s time, we bring them to the crematorium where they are cremated. Our different cremation services include those for unattended funerals as well as attended, and our Aura Angels are there with you at every step of the way to discuss various options.

After the cremation, we will hand-deliver the ashes to your home for a nominal fee (if there is no funeral plan in place), or scatter the ashes in the crematorium’s Garden of Remembrance, whatever suits best. If you’re interested in putting together a celebration of life or gathering after the funeral, we can help with that, too.

Different types of funerals and their costs can vary quite a bit. For instance, a traditional burial will incur more expenses than a direct cremation. However, for average funeral, there will be costs associated with:

Getting detailed quotes from different providers will give you a well-rounded picture of how much you can expect to pay for the type of service that fits your family’s needs.

Funeral directors will usually provide a clear, itemised quote upfront. This helps you understand what’s included, compare options, and decide what the estate or family can realistically cover cost wise.

The executor’s role involves overseeing all administrative jobs after someone dies. This includes managing the person’s estate and liaising with the bank to release the money, which can often be used to pay for the funeral. Banks can also release money from the person’s account directly to the funeral director, streamlining the process a little more.

In some cases, executors may need to sell belongings, such as property or vehicles, to generate the necessary funds to settle any debts and pay taxes.

Funeral expenses can be claimed from an estate to cover any essential funeral expenses, and it may be possible to write off the tax that would otherwise be due, including:

However, more elaborate items such as luxury coffins, large floral arrangements, or extended receptions are usually considered non-essential and therefore might be contested by the beneficiaries, or rejected by the government for tax purposes. These items may have to be paid for by the family or other parties who wish to include them if they deem them necessary.

Prepaid funeral plans are an effective way to minimise financial pressures from families. By arranging and paying for services in advance, you can ensure that your loved ones are not left paying for an expensive funeral, especially if you’d like something a little more simple.

These plans also simplify the executor’s responsibilities, as the necessary funds have already been secured. However, you may wish to ensure that the plan covers all intended costs to avoid unexpected deficits.

Aura’s funeral plans guarantee your funeral costs when you die, which means no matter how high funeral costs might rise in the future, your family has nothing to pay when the time comes. Purchasing a funeral plan brings great peace of mind to both you and your family knowing that, when a difficult time comes, there is one less thing to worry about.

It’s worth checking whether the person who has died had any life insurance, such as an over-50s plan or funeral policy, that pays out a lump sum. Some workplace or personal pensions also include a death-in-service benefit or one-off payment for the next of kin. These funds can often be used to help pay for the funeral.

Look through any paperwork or contact the person’s employer, pension provider, or insurer to see what’s in place. In some cases, payments can be fast-tracked or sent directly to the funeral provider, easing some of the financial pressure at an already difficult time.

Government schemes and some charities offer financial help for funeral costs. One option is the Funeral Expenses Payment, part of the UK’s Social Fund.

You may be eligible if you’re arranging the funeral, receive certain income-based benefits or tax credits, and were a close relative, partner, or friend of the person who has died. The funeral must usually take place in the UK or the EEA, and the payment is only available if no one else has already paid.

This support helps cover essential costs like cremation or burial fees, doctor’s fees, and travel to the funeral. It doesn’t usually cover extras like flowers or a wake, and may not cover the full cost. To check if you qualify, visit the government website, Citizens Advice, or read Aura’s guide on how to claim funeral costs.

If the person who died was a child (under 18, or a stillborn baby after 24 weeks), the Children’s Funeral Fund will cover cremation or burial fees in England. Similar support is available in Wales and Northern Ireland, so bereaved parents aren’t left with these core expenses.

Though somewhat unconventional, crowdfunding has become a helpful tool for raising money for funeral expenses. Calling on a larger network of friends, colleagues and relatives opens up possibilities for raising the money needed to cover portions of, or an entire funeral service.

Coping with the death of a parent can be an emotionally complex experience, often accompanied by grief, responsibilities, and, at times, family tensions. Whether their death was expected or sudden, it can bring up unresolved emotions, financial considerations, and disagreements over their wishes. Knowing what to expect can help you navigate this difficult time with clarity and support.

Beyond the emotional toll, losing a parent also brings practical challenges. You may need to step into new responsibilities, from handling their estate to managing funeral arrangements. In some cases, these decisions can lead to disputes, especially if family members have differing opinions on what should happen next.

It’s also worth knowing that any funeral wishes, whether set out in a will or shared before death, aren’t legally binding. Executors or family members should try to follow them where possible, but they aren’t required to carry out requests that would put financial strain on the estate or family. That can offer some comfort when facing difficult decisions.

Aura is here to help support you during the sometimes challenging and disorienting times of loss and planning. Whether you’re looking to purchase a prepaid plan or need to begin arranging a funeral now, we’re only a phone call away.

Our people-centred approach is what makes us truly unique. Paul Jameson founded Aura after his own difficult personal experience confronting mortality after being diagnosed with motor neurone disease. Understanding the challenges people face, he created Aura with genuine care and compassion at the root of our company. We deliver quality service, as this is exactly what we would want for our own families.

Our dedicated team works closely with every person who turns to us, ensuring you receive our full attention and support. We’re here to provide you with the best possible care, tailored to your specific situation.

No, families cannot be legally forced to pay for a funeral unless they’ve personally agreed to do so. For example, by signing a contract with a funeral provider. If there is no estate (money or assets left behind by the person who died), and no one steps forward to pay, the local council has a legal duty to arrange a Public Health Funeral. This is usually a simple cremation with no service or attendees.

Not automatically. Being next of kin does not make you legally responsible for funeral costs unless:

You are also the executor and are managing the estate.

You personally arrange the funeral and sign a contract with a provider.

If there is a will, the executor is typically responsible for handling funeral arrangements and ensuring costs are paid from the estate. If there is no will, next of kin often steps in to make arrangements, but they are not legally obliged to do so unless they agree to the costs.

If no family is found or no one is willing or able to arrange the funeral, the local authority will arrange a Public Health Funeral under the Public Health (Control of Disease) Act 1984. This ensures that even individuals who die alone or without funds receive a respectful, legal burial or cremation.

No relatives will be expected to pay unless they choose to be involved or have already signed a funeral contract.