At Aura, we listen to our customers. That’s why we know just how important it is for you to feel secure about your funeral plan investment.

We are here to support you with care and compassion, and that extends to protecting your funds as well. We make sure that your money is safe until it’s needed, giving you and your loved ones peace of mind for the future.

Whether you purchase your Aura funeral plan through a lump sump or monthly instalments, we care for your funds by placing them into a secure trust. This keeps your money completely independent of our company’s finances. Our trust is fully funded and able to fulfil every funeral plan purchased with us.

The independent trust is managed by a group of trustees separate from Aura. Their responsibility is to protect the money you’ve given to us and ensure it is ready to cover your cremation when it is needed.

The trustees perform regular reviews that measure the performance of the trust to prevent any harm to your investment. Aura also conducts an annual review of the company’s finances to ensure we can support our clients and that the business is financially stable.

When the time comes, your funds will be released from the trust and used to cover all the costs specified in your prepaid plan with Aura. Your funeral can then go ahead according to your wishes, with no extra payments needed from your loved ones.

Every year, funeral plan providers are required to perform a solvency report via an Actuary. This report includes an assessment of all of our assets and our liabilities to produce our funding level, which shows whether our Trust holds enough money to cover the cost of every funeral plan.

A funding level above 100% shows strong financial health, and the higher the percentage, the greater the financial security for our plan holders. In our last review, Aura’s trust had a funding level of 128%.

This means that our trust has more than enough funds to cover the costs of all plan holders’ cremations as promised.

Since July 2022, all companies selling prepaid funeral plans must now be authorised by the Financial Conduct Authority (FCA). Through regular checks, training and rigorous standards by the FCA, providers are held to a high standard. This regulatory shift is a welcome change for customers as the funeral plan industry is now more transparent, offering greater security and protection.

The Financial Services Compensation Scheme (FSCS) offers protection if a funeral plan provider can’t meet their commitments. In the unlikely event that Aura went out of business, the FSCS may step in to compensate you with coverage of up to £85,000 per individual. As an independent organisation backed by the government, the FSCS offers its services free of charge.

By setting strict regulations, the FCA can make sure that funeral plan providers operate with integrity. These rules are in place to protect consumers. If a company does not comply, its authorisation to sell plans can be revoked.

Funeral plan providers must communicate clearly in all interactions, whether that’s online, in marketing or over the phone. The FCA wants to prevent misleading practices and ensure that customers fully understand their purchase.

The FCA’s regulations have driven a complete culture shift in the industry. Every employee is responsible for maintaining high ethical standards and receives regular training. This ensures that funeral plans are sold without pressure.

Funeral plan companies now must secure your investment either in an independent trust or insurance contract. This keeps your funds safe and ensures they are properly managed, so they’ll be available when your family needs them.

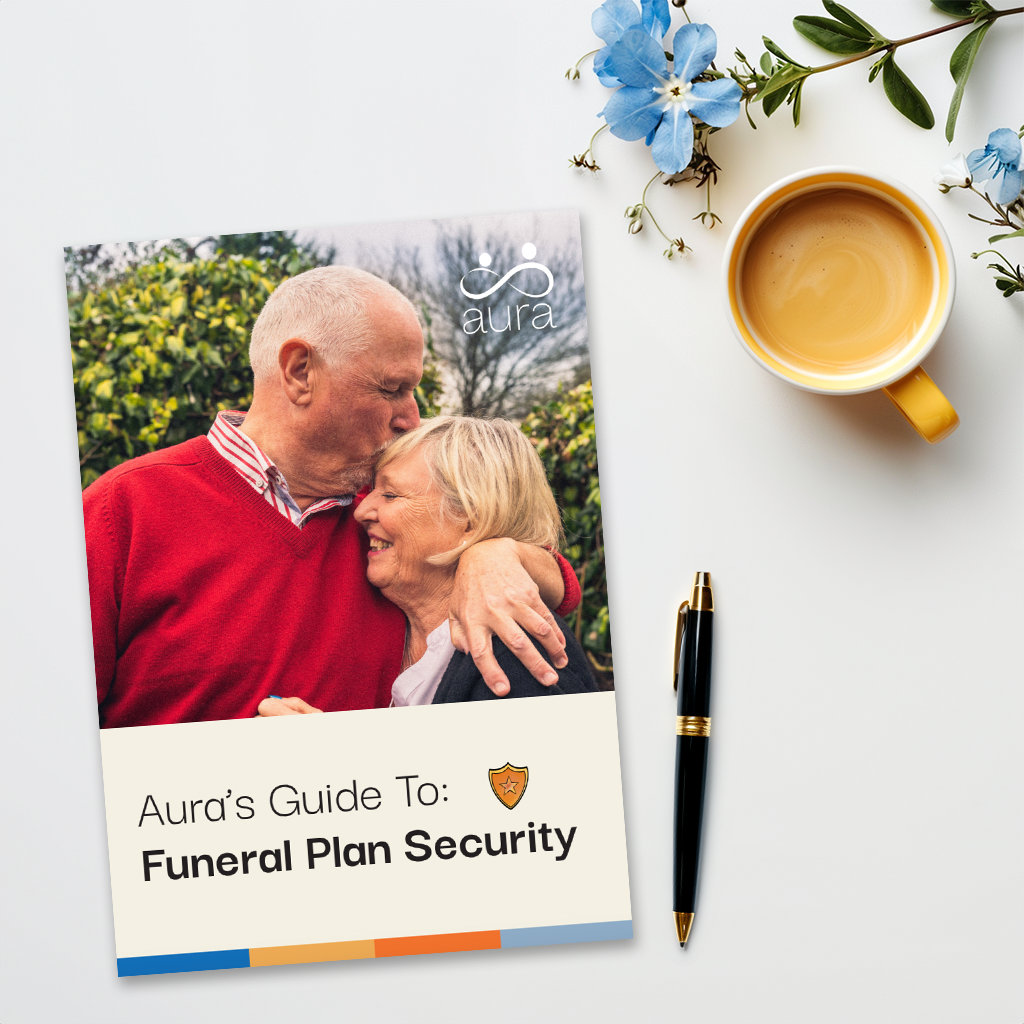

If you want to know more about how your funeral plan is cared for, our downloadable guide provides the details you need to feel confident. Discover the steps Aura takes to protect your funds and the regulations in place to keep your money safe.

Download our guide by clicking the link below and gain peace of mind for the future.

Funeral costs are steadily increasing every year. A report by Legal & General suggests they could rise as much as 84% over the course of 20 years.

By securing a direct cremation plan with Aura, you can protect yourself and your family from potential inflation. Our plans include all the necessary costs of your funeral, even if prices do increase, there is nothing left to pay when the time comes.

A prepaid plan can bring peace of mindℹ to the ones you leave behind. It gives them the comfort of knowing the kind of funeral you wanted and reduces their stress during a time of grief.

You also relieve your family of the financial burden of arranging your funeral. By handling your funeral costs in advance, you can bring comfort to your loved ones, ensuring they won’t have to worry about the finances.

By securely protecting your funds and providing an exceptional service, Aura offers peace of mind to every family who needs us. It’s this dedication to security and care that has earned us an outstanding 4.9/5 stars on Trustpilot, making us the highest-rated ‘Cremation Services’ provider on the platform.

The International Compliance Association (ICA) holds annual awards to acknowledge the hard work performed by compliance and financial crime prevention teams.

As an FCA-regulated provider, we understand how important it is to uphold compliance standards and ensure our customer’s best interests are protected.

In 2024, our Compliance team was proud to win the ICA’s ‘SME Compliance Team of the Year’ Award, recognising our dedication to maintaining industry-leading practices and processes that put our clients first.

To see our full list of FAQs, please click here.

Although it is very unlikely that Aura will go out of business, we want to reassure you that your funeral plan is well protected just in case.

If something were to happen, your plan would be transferred to another FCA-authorised provider who will make sure it is honoured. If a transfer isn’t possible or you prefer not to switch, your funds will be returned to you.

Additionally, in the worst-case scenario, you are protected by the FSCS, which can provide compensation.

The FCA’s regulation of the funeral plan industry offers greater transparency and honesty in the industry. Their guidelines ensure that providers are honest with the services they offer and are responsibly managing your money.

Over 50s life insurance will pay out a lump sum to your chosen beneficiaries after you pass away. It does not guarantee that this amount will cover all of your funeral costs.

A funeral plan allows you to pre-arrange and pay for your funeral in advance. This does guarantee that all funeral costs will be covered, leaving your family with nothing left to pay.

If you would like to verify if a funeral plan provider is authorised, you can easily check on the FCA’s website.

Aura’s plans are all-inclusive. This means that all the necessary costs surrounding your cremation are covered in the upfront cost, so there’ll be absolutely nothing left to pay when our services are needed.

This includes:

– The collection of the person who has passed from a hospital or mortuary setting.

– A simple coffin.

– All cremation fees.

– The removal of medical devices.

– Unwavering support from our team of funeral experts.

If you have any questions, would like a brochure or simply would like a chat through our services, our award-winning team is here to help.

Unlike other providers, we won’t hassle you with constant calls. We’ll simply ensure you have the information you need and leave you to come to a decision in your own time. When you’re ready for us, our team will be ready to help.