Written by Adam McIlroy.

21 minute read

Article reviewed by Steven Barratt, Founder of Save Funeral Costs on December 11, 2025.

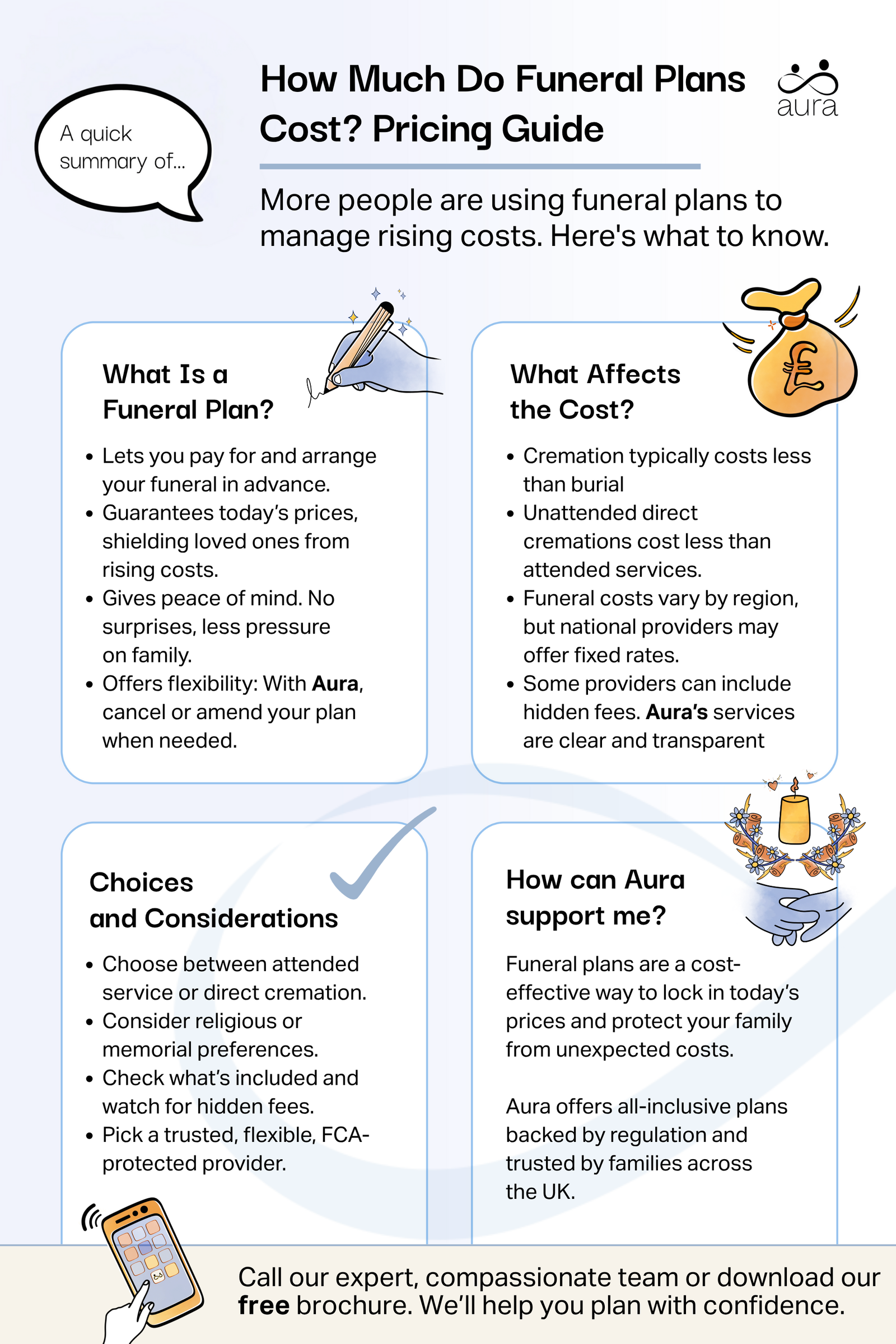

More and more people these days are turning to funeral plans as a way of managing their expenses, and of combatting the potential for rising funeral costs. One of the first and most important questions we ask ourselves when beginning to think about this option is “how much do funeral plans cost?”. In this article, we aim to answer that question and more, arming you with the information you need to make an informed decision about your future funeral.

At Aura, we know that any number of things can spark our thinking about getting a funeral plan sorted, so we just wanted to say that, if a recent bereavement in your life has brought you here, that we understand the emotional difficulty that you might be in. Aura offers its compassionate, family-run funeral services to all who need them, along with the caring, industry-leading support of our Aura Angel team.

These services are available to those looking for a direct cremation funeral in the here and now, and those planning ahead for their own future.

*Terms and conditions apply. You will receive a funeral plan summary before purchase.

Key takeaways:

A simple way of understanding what a funeral plan is is to outline what it allows you to do: by getting a funeral plan in place, you can pay for and specify everything about your funeral in advance of the day itself. Depending on the provider, different types of burial or cremation costs are covered by your plan.

The main benefit of a funeral plan is all-round peace of mind. You can relax knowing that you will have exactly the kind of funeral that you’re looking for, and that everything is paid for in advance, guaranteeing everything at today’s prices. Your family can also breathe a sigh of relief: they know that when the time comes, they won’t have to step in and pay part or all of the costs themselves at short notice, and – perhaps even better – they also know that they are not going to have to decide on important choices for you, without being able to talk to you about your funeral options.

Another benefit of a funeral plan is flexibility. At Aura, we believe that our customers should feel comfortable and happy with their decision; they shouldn’t feel trapped the minute they’ve paid. Many funeral plans will let you cancel or amend things as you please, but, as you will see, this is not always the case.

Each year, different consumer or finance bodies report on funeral costs, giving you lots of useful data to weigh up. For example, there’s the SunLife Cost of Dying Report, which tracks funeral-price rises across the UK, splitting them out across locality, and by individual funeral expenses, such as the cost of a wake, or of an attended service. There’s also Funeral Solution Expert who offer their own data, analysing the funeral plan market.

According to the report by FSE in 2025, the average cost of an unattended direct cremation funeral plan is £1,700, while a fully attended cremation plan averages £2,750. They also note that traditional funeral plans are significantly more expensive, with an average of £4,100 for cremation vs burial. However, it’s important to understand that your overall funeral expenses could be far less or more than this range depending on the type of funeral you’d like to arrange, the things you’d like to include, and what happens afterwards.

There are lots of different options out there, which is why it’s always a good idea to compare funeral plan providers before you make your final decision. It can be helpful to head to objective consumer sites when conducting your research, such as Martin Lewis’s MoneySavingExpert. Many people search online for terms like “does Martin Lewis recommend funeral plans” when weighing up their options. While he doesn’t promote specific providers, Martin Lewis and his team do highlight that funeral plans can be a good way to lock in today’s prices and protect your family from unexpected costs — as long as the plan is FCA-regulated and clearly explains what’s included. Doing this can help you to get impartial information about what a funeral plan is, as well as a general sense of how much a funeral costs.

A prepaid funeral plan is designed to cover all aspects (or as many as possible) of a funeral, meaning that there are many different variables impacting the final price. For instance, the type of funeral service; the location of the funeral and the provider you choose; and the different payment options can all have an impact on your final price.

Whether you’re looking for cremation services, or a burial is only the first thing you need to decide; you’ll also need to consider whether you’d like mourners to be present or not. The difference in price between an unattended direct cremation plan from Aura, which start from £1,695, and a fully attended burial can be quite vast, so this decision is potentially the most important for impacting the overall cost. In general, cremation is cheaper than burial, as the plot of land and headstone don’t need to be purchased with the former option.

These days, many of us are turning to direct cremation plans as a way of arranging a low-cost funeral; they allow all of the practical matters to be seen to, without the fuss and expense of a traditional funeral. What you might decide for after your funeral can also make an impact on the overall cost. For instance, many families like to arrange an end-of-life celebration for the loved one they’ve lost, and others like to integrate cremation ashes ideas into their funeral planning, such as an ashes firework or an ashes tree. These additional extras can drive up the overall cost.

Location can affect funeral costs. For example, SunLife placed the cost of a simple attended funeral in Northern Ireland at £3,105, where as in London it could cost as much as £4,897. Legal & General show big differences between average funeral costs in rural and urban areas: for Wales, the average cost of a cremation is £3,900, and £5,000 for a burial, whereas in ‘Greater London’, the figures are £4,900 and £8,800 respectively.

There are, however, national providers like Aura, who charge the same price regardless of your location, which is something else it might be worth factoring into your thinking.

The payment options available with each provider can impact your final price, too. Most providers will allow you the chance to either pay all in one go for your funeral plan, or to pay in instalments over months and years. It’s very important that you understand the fees involved with paying in instalments: some providers will add an interest fee per payment, as well as an admin payment fee per instalment. This can obviously have the impact of making the final price you pay quite different depending on which payment method you select.

With Aura, you may be pleased to read that we don’t charge any admin fees for monthly instalments. You can pay the cost of your plan in a lump sum, or in 12-to-24 monthly instalments at no extra cost, giving you the complete freedom to decide what’s best for you.

What’s included in funeral plan costs will vary from provider to provider but in general certain basic expenses are usually included in the price offered. There might also be optional add-ons that you can pay for with your funeral plan, as well as certain things which might be excluded from your final price.

In general, a funeral plan will cover such funeral costs as:

There’s a wide range of different extra things that could also be included in your plan, but, as ever, it will depend on the kind of funeral you select, and the provider. For instance, with Aura’s funeral plans, we also include the service of hand-delivering your ashes back to your family, and the cost of an oversized / bariatric coffin, should it be needed. This may not be the case with other providers.

There’s a whole range of optional add-ons that you can select when sorting out your funeral plan. For instance, with Aura, you can choose an attended direct cremation service as an optional extra. This allows you to specify in advance that you’d like family and friends to attend your cremation, which can happen at a crematorium local to you. We can even support your family, when the time comes, in finding a local celebrant or religious minister to design and officiate a ceremony tailored to your life-story and interests.

If your family would like to honour you with a celebration of life, anything they plan to do would be an extra expense, but some funeral plan providers can offer administrative or logistical support with celebration planning as an optional extra.

It’s also very important to be aware of what your funeral plan doesn’t include. With burial plans, for example, although it might seem reasonable to assume, the cost of the plot where the grave will be situated may not be included in the overall cost. Similarly, although Aura can help to put your family in touch with a third-party officiant, like a secular celebrant or religious minister, should you wish to have an attended ceremony, their own fees are not included in the overall price of your plan. That’s because in general the people who offer these services are self-employed, and charge their own fees. We don’t take a percentage of any money paid to a celebrant, though, even if we help you to find them.

For things like this, you might need to keep track of the different extra costs that will be involved for the type of funeral that you want to preplan. A funeral checklist can help you to organise the different burial or direct cremation costs that might be involved with your choice.

You can see what is and is not included in Aura’s unattended direct cremation plan below, helping you to more effectively plan a cost-effective funeral with us.

What is the ‘right’ funeral plan for you will depend on many different things, from your budget and payment preferences, to your religious beliefs on death and funerals, to whether or not you would like your funeral to be attended.

With the decline in religion in the UK in recent decades, there are fewer and fewer religious funerals happening across the country. This partly explains the rise in direct cremation, as British people seek modern, low-cost alternatives to the traditional norm.

Ask yourself whether you would like your funeral to be attended or not; with Aura, you secure a funeral plan that allows you to have a completely unattended direct cremation, an intimate farewell attended by a select few loved ones, or a fully attended service. You might also want to consider whether you’d want your family to have a special memorial for you after your cremation or burial, which can be a really important part of remembering a loved one. If so, proposing a few ideas for personalisation and working out some of the costs of that ahead of time could help you to prioritise your spending elsewhere.

Having a clearer understanding, or vision, of the funeral that you would like for yourself, including the level of personalisation right for you, makes it much easier to assess your needs, and to find the right funeral plan for you.

An absolutely key part of the process of sorting a funeral plan for yourself is the comparison process. You can compare Aura’s funeral plans with other leading providers’ by considering the table at the bottom of this section. It can help you to evaluate all of the important elements, from price, to reputation and accreditations, to payment-method flexibility.

Many people search online for advice using terms like “does Martin Lewis recommend funeral plans” — and while he doesn’t endorse specific providers, Martin Lewis and his MoneySavingExpert team have shared useful guidance. They often highlight that funeral plans can offer peace of mind by locking in today’s prices and removing financial pressure from loved ones, as long as the provider is FCA-regulated and your money is properly protected.

At £1,695, Aura’s funeral plan starting price is less than half of the national average total cost of a funeral, according to SunLife, making us one of the most affordable options on the market. But price isn’t the only factor you may wish to consider. We are also the top-rated national ‘Cremation Services’ provider on Trustpilot, with a score of 4.9/5 stars. You can read what the families who’ve already entrusted themselves to our care have said about their experience by heading to Trustpilot. And, with our full regulation by the FCA, and full plan protection from the FSCS, if you’re wondering “Are Aura’s funeral plans safe?”, we can tell you that they most certainly are.

When it comes to the payment option you’d like, you’ll need to consider whether you want to pay an instalment fee or any interest on your payments (and sometimes, depending on the length of time you want to pay over, you could end up paying both of these add-ons simultaneously!). Most providers will give you the option to pay everything up front in one go, or to spread the cost over time.

Aura provides both a lump-sum, and an instalment option – giving you the choice to pay over 12-to-24 months. Whether you pay all at once, or over two years, your final price will be exactly the same. Not only that, but we won’t penalise you if you’d like to amend, or even fully cancel, your plan after purchase. You can do so for any reason, at any time, and you’ll only pay extra if you want to upgrade your plan to a bigger size; if you cancel you will receive a full refund.

| Starting Price | £1,695 | £2,095 | £1,700 | £1,700 | £1,885 |

| Trustpilot | 4.9/5 stars | 4.8/5 stars | 4.6/5 stars | 4.8/5 stars | 4.5/5 stars |

| Fairer Finance | |||||

| All-Inclusive Pricingℹ | |||||

| Free Cancellation Anytimeℹ | |||||

| Money-Back Guaranteeℹ |

This comparison only includes direct cremation plans. Information is correct as of January 2026. Please note, Aura’s offering above is only applicable to plans paid in instalments up to 24 months. For those paying via 5-year instalments, different terms and conditions apply.

Aside from paying for a funeral plan, there are a number of other ways you can think about how to pay for a funeral ahead of time. From building up a bank of personal savings, to purchasing a life insurance policy, to government or charity assistance and crowdfunding, there are lots of different options to consider.

You can put away a regular contribution for your funeral costs in a savings pot or bank account in order to pay for your funeral when you’re no longer here. Of course, like this, you’ll be able to watch your savings grow gradually, and have more control of the money. But, there are a few different downsides to this approach.

The first negative is that, in saving your money like this, it may not keep pace with the potential effects of funeral inflation, or with possible funeral price rises. When you buy an Aura funeral plan, we place your money into our secure, independently managed trust. This means you will guarantee today’s funeral prices, even if your funeral isn’t for decades to come, and your money will be protected from funeral-prices and possible inflation.

Furthermore, if your intention is to save the money in your bank account, keeping it there for family members to access when the time comes, this could come with administrative hurdles for them: they will likely need your Death Certificate in order to gain probate and administer your estate, or access and close your bank accounts. Because of how long it takes to arrange a funeral, this can take longer than you might think. It means they might first need to pay for everything themselves and then reimburse themselves later with your money. Aura’s trust allows them to avoid this hassle.

Many people, as an alternative to a funeral plan, buy an over-50s life insurance policy instead. This type of insurance is often chosen by people searching for what insurance covers funeral costs, or looking for insurance for covering funeral expenses later in life.

In many ways, it’s a very similar idea to a funeral plan, but with a few key differences that you should be aware of. First of all, as noted by Martin Lewis, depending on how old you are when you start paying your premiums, and how long you live for after this start date, you may end up paying in more than you get back, meaning you may have been better off not bothering, and simply saving the money.

Another possible drawback of an over-50s life insurance policy is that the insurance provider might need to see legal proof of your cause of death before they pay out, which, again, could leave your family in a tricky spot when it comes to paying for everything in a timely manner. Finally, if you should miss one premium payment then, regardless of how long you’ve been paying premiums for until that date, you may no longer be covered, and the policy may be void. Nor can you get your money back if you decide to cancel; you will not be refunded as you would with Aura should you want to cancel your funeral plan.

Naturally, whether you’re choosing a burial or a cremation, funerals can be costly at the best of times. Paying for a funeral is a big cause of anxiety, particularly when we are trying to cope with the death of a parent or a close friend. If you find yourself struggling to work out how to pay for funeral expenses, or if you’re worried your family might struggle with the cost of yours when the time comes, there are some support schemes out there which could help.

The Department of Work and Pensions (DWP) has two programs helping those in need in Britain: the Bereavement Support Payment and the Funeral Expenses Payment. In Scotland, the Funeral Support Payment may be helpful. Your family may also be able to gain access to your bank or building society account in order to pay your funeral costs directly from your funds there; this can be done through the Grant of Probate scheme.

Finally, there are some charitable organisations, often associated with certain professions, which can provide some financial support too; the Quaker Social Action charity can help to point you in the right direction on this.

More and more people, in facing increasing financial difficulty, are turning to crowdfunding as an option to help raise funeral funds. Families can ask the wider family and friends of someone who has died for a financial contribution towards funeral costs, with families often choosing to split costs evenly among themselves.

It’s also possible to look for support from the general public, on such platforms as GoFundMe or JustGiving, which often help families to quickly raise the funds they need to pay for funeral expenses through the generosity of others.

We hope you have found this overview of funeral plan costs useful. Aura is one of the UK’s leading funeral plan providers, with stellar customer support, low-cost options, and the flexibility of free cancellation and amendment. If you have any questions about how to pay for a funeral plan, or if you’d like us to help you set one up, we would be very pleased to receive your call. You can give us a call whenever you’re ready, and we’ll talk you through everything you need to know.

If you’d like to know more about how to plan a cremation with Aura, our brochure is a helpful place to begin.

Our funeral plans are a helpful way to put everything in place for you or someone else.

When the time comes, our experienced team will be here to guide you through each step, offering support and advice whenever you need it.

To find out more about how our plans work, what’s included, and our story, you can request a brochure by clicking the link below. We will then send you a copy by email or First Class post—whichever you prefer.

Costs vary depending on the type of service, provider, and payment option. Simpler cremation plans tend to be more affordable than traditional burial services.

Generally, cremation is less expensive than burial, which often includes the cost of a plot, headstone, and other associated fees.

Most plans cover essentials such as cremation or burial fees, a coffin, transport, and basic administration. Some plans also include extras like ashes return or a larger coffin.

Yes. Some common exclusions are:

Many providers allow cancellation or changes, though terms vary. Aura, for example, offers full flexibility without penalties.

A prepaid funeral plan usually fixes costs at today’s rates, protecting you against inflation.

Think about whether you want an attended or unattended service, what kind of memorial matters to you, and how much flexibility you want. Comparing providers can help you decide.

Alternatives include personal savings, life insurance, government support, or even crowdfunding. Each has different pros and cons.

Yes. Aura is regulated by the Financial Conduct Authority and protected by the Financial Services Compensation Scheme.