Written by Adam McIlroy.

26 minute read

Article reviewed by Helen Hardware, Former Head of Risk & Compliance at Aura on March 5, 2025.

When we find ourselves needing to arrange a funeral at short notice, the cost is often one of the first things on our mind. Whether we are dealing with the unexpected death of a loved one, or wondering how to cope with the death of a parent, we might be wondering “what insurance covers funeral costs?” or how we can access their financial information to help pay for a funeral. In these urgent situations, it’s also common to ask does next of kin have to pay for funeral costs if no insurance is in place – our guide on next-of-kin responsibilities explains how funeral expenses are handled legally and who can help with funeral costs.

Of course, you may also be planning ahead for your own funeral, and considering your various options, too. In this article, we are going to answer the question “what insurance covers funeral costs?” and many other connected questions. And if you’re specifically concerned about covering a parent’s funeral in advance, you may find our guide on funeral cover for parents helpful in exploring the best options.

Whatever has brought you to this page – whether you need to arrange a direct cremation for a loved one in the here and now, or you’re looking for a prepaid funeral plan for the future – we just want to acknowledge the possible difficulty or emotional complexity of your situation. Aura is ready to offer its family-run funeral services to any who need them.

Key takeaways

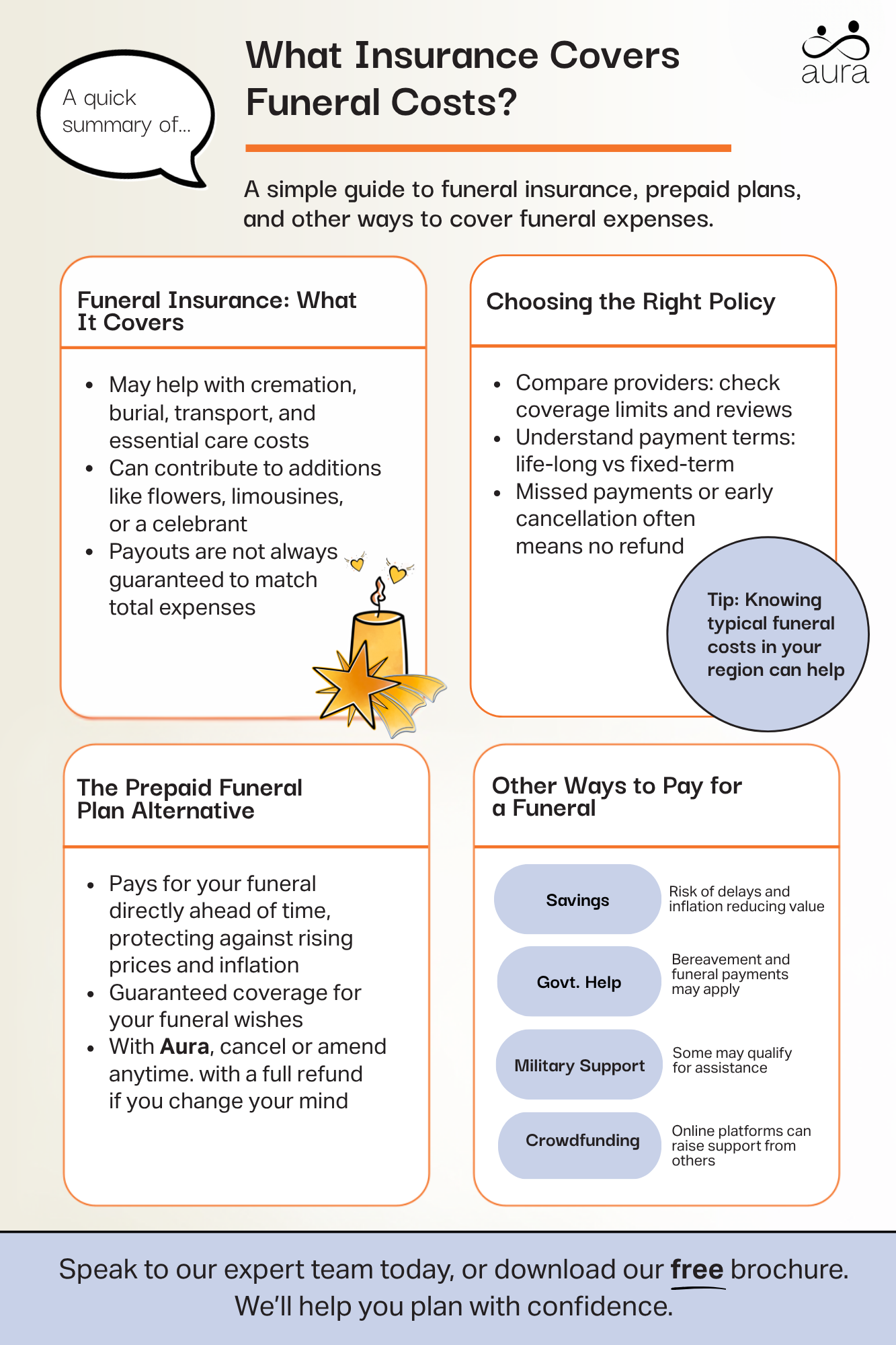

‘Funeral insurance’, such as over-50s life insurance or funeral cover insurance is a popular choice in the UK by those looking to make sure that they cover how much a funeral costs in advance of their death and funeral. Some people refer to this type of policy as a funeral expense insurance plan, as it’s designed to help cover the costs that arise when someone dies, whether that’s a simple cremation or a more traditional service. For some people, this may mean covering only the basic expenses, while others hope the payout will stretch a little further. It’s worth noting that in some cases, funeral insurance may not fully cover the cost of a funeral.

In general, in the case of over-50s life insurance, a lump-sum will be paid out upon the redemption of the policy, which could be used to pay for some or all of the policy holder’s funeral costs. Whereas, with funeral cover insurance, the policy holder will have specified in advance with the provider what sort of funeral they want, and the insurance provider undertakes to pay the funeral provider some or all of the cost of the funeral once the policy holder has died. In effect, funeral cover insurance is a bit like a prepaid funeral plan, only it is backed by a life-insurance provider, rather than a trust.

Both examples of funeral insurance policies can be used to cover basic funeral or cremation costs. These may include typical fees associated with funerals, such as cremation or burial costs; funeral director fees; the pre-funeral care of the person who has died, such as washing and embalming; or their transportation to the crematorium or burial site on the day. Depending on the type of funeral the family wants to opt for, and the type of funeral insurance policy they have, it may also need to cover more expensive fees, such as burial-plot rental, and headstone purchase.

If you’re planning a burial specifically, you may come across the term “funeral burial insurance policy.” This usually refers to a type of cover intended to help with burial-related costs, such as a plot, interment fees, or a headstone. Not all insurance plans include these by default, so it’s worth checking what’s covered.

Depending on the size of the payout, a funeral insurance policy could also cover additional expenses. For example, if a family wants to arrange an attended direct cremation or burial, then they may want to use the payout for celebrant or religious minister fees, not to mention floral tributes to the person who has died, or a limousine and funeral procession for the family.

It’s very common, depending on different beliefs on death and funerals, for some sort of wake or end-of-life celebration to follow the funeral ceremony itself. Depending on what sort of thing the family would like to do, these can also be expensive additional extras.

It’s also important to know that the money from a life insurance policy, including over-50s plans, doesn’t have to be used for funeral expenses. Once it’s paid out, the beneficiary can use it however they choose. That’s why it’s a good idea to talk about your wishes in advance.

These plans usually offer a fixed lump sum, often just a few thousand pounds, and don’t normally require a medical exam to qualify. That can make them more accessible, especially for those with health conditions. But the smaller payout means they’re often only enough to cover basic funeral costs.

It’s very important to bear in mind, as noted by impartial consumer experts like Martin Lewis, that funeral insurance, like over-50s life insurance coverage, may not apply in certain situations. For example, the insurance provider may not provide cover in instances where the policy holder has died by suicide.

Whilst it’s not normally the case, you may need to undergo a medical before you are accepted; if you declare that, for example, you are not a smoker, but a post-mortem finds that you were, again this may invalidate your policy.

If you are considering a funeral insurance policy, make sure you are aware of the exclusions and exceptional circumstances where the policy may no longer apply, as this can affect your family’s help with funeral costs.

If you are interested in paying for your funeral with a funeral insurance policy, you’ll need to make sure you are getting the best deal. Assess your coverage needs, and compare the different providers out there to see which one can help you meet those needs more closely. You’ll also need to make sure you understand the payment and beneficiary terms of your policy. Consider starting a funeral checklist in order to keep your research organised.

Because funeral insurance policies do not lock in current funeral prices when you start paying, you will need to be aware of typical burial and direct cremation prices in your area of the UK before making your decision. You will also need to be aware of how quickly funeral costs are rising, and of how much money your policy is likely to pay out when the time comes. This will give you a rough idea of how to balance your needs against the demands of the economy when the time comes for your funeral.

According to SunLife, traditional attended funeral costs have increased by 146% since 2004, so this is an important consideration to make. They also say that the national average total cost of a funeral in the UK last year was £5,140, but you could pay significantly less or more than that depending on what kind of funeral you want and where you live. Once you’ve weighed up the benefits and costs of cremation vs burial, and gotten a sense of how your local funeral costs stack up against those of the rest of the UK, you’ll have a clearer idea of how much coverage a life insurance policy will get you.

When estimating coverage, some experts suggest setting aside a portion of your life insurance specifically for funeral expenses. As a rule of thumb, you might plan for around 10% of the payout to go towards funeral costs, depending on the size of your policy and the kind of funeral you have in mind. This can be a useful starting point, but it’s important to check real-life costs to make sure the figure matches your actual wishes.

Always check that the total payout will be enough to cover those costs in future. Funeral prices are likely to keep rising, so it’s sensible to build in a little extra to account for inflation. Being realistic about what your funeral might cost means your family will be less likely to face any shortfall later on.

As with any important financial decision, make sure to compare the different providers that are out there. You might find differences in premium price, or coverage limits that are more relevant to your needs. And there may also be variance in how each provider pays out.

If you’re trying to find the best funeral cover plan for your situation, price isn’t necessarily the only factor you will want to consider. The financial stability and trust rating of the company are equally important, as, ultimately, they are the ones you are trusting to provide the money for your funeral. You can compare the Trustpilot rating, for example, of each company to see what previous customers have had to say about their experience. Each company may have an awards and accreditations section of their website that shows you different reasons to put your trust in them.

With over-50s life insurance, you will usually need to name someone as the policy beneficiary. This is the person who will use the Death Certificate to claim the payout from the insurance provider when the time comes. The beneficiary is often a close family member, such as your next of kin. Once they’ve received the money, they will be responsible for using it according to your wishes.

Here are a few important things to keep in mind:

Your beneficiary is not legally required to spend the payout on the funeral.

They have full control over how the money is used, which means it could be spent elsewhere if your wishes aren’t clearly understood.

Have a conversation about your wishes.

Talking openly with your beneficiary helps ensure they know you would like the insurance money to go towards funeral costs.

Funeral instructions in a will are not legally binding.

Even if you include detailed funeral directions in your will, the person managing your estate isn’t legally required to follow them. That’s why personal communication is so important.

Some insurers offer funeral-specific add-ons.

You may be able to add a ‘funeral benefit’ to your policy. This can earmark a portion of the payout for funeral costs, or pay a fixed amount directly to a funeral provider. For example, some policies include an additional £300 for this purpose.

A prepaid funeral plan offers more certainty.

If you want to be sure that the money goes directly towards your funeral, a dedicated prepaid plan can provide that assurance. It also removes the burden from your loved ones during a difficult time.

Many people wonder whether life insurance payouts are taxed. In most cases, a life insurance payout is not subject to income tax, which means your beneficiary can receive the money tax-free.

However, if the payout is made into your estate, such as when the policy is not written in trust, it could be counted towards your estate’s total value. If your estate exceeds the Inheritance Tax threshold in the UK, this could reduce the amount your loved ones receive to help cover funeral and other costs.

One way to avoid this is to write your life insurance policy in trust. This means the money is paid directly to your chosen beneficiary rather than going through your estate. It can help protect the payout from Inheritance Tax and may also allow it to be paid out more quickly, without the need for probate.

If you’re considering this option, it’s a good idea to speak with a solicitor or independent financial adviser who can help you set things up correctly.

The main alternative to over-50s life insurance as a means of paying for your own future funeral is a prepaid funeral plan; this is sometimes referred to as “pre-need funeral insurance”, although, as it’s not actually an insurance product, this name isn’t as appropriate.

The easiest way to understand what a funeral plan is, is to understand what it does: to put it simply, a funeral plan allows you to specify your funeral wishes – that is, what kind of funeral you would like to have – and to pay for it all in advance of the day itself. Unlike over-50s life insurance, your family doesn’t receive a cash lump-sum when you die. Instead, with an Aura prepaid funeral plan, they let us know that the time has come to activate your plan, at which point we withdraw your money from our trust to pay for everything you’ve specified.

There are numerous benefits available to you with a prepaid funeral plan compared to funeral insurance, as you will see from the comparison table below. With an Aura funeral plan, it is guaranteed that your funeral will be completely paid for; this is not the case with funeral insurance.

Certainty

With an Aura funeral plan, it is guaranteed that your funeral will be completely paid for; this is not the case with funeral insurance. With the latter option, you may get a lump-sum which the family will need to conserve and spend wisely in order to cover funeral costs, or they may otherwise find that they need to make up the difference between what the policy pays to a funeral director, and the overall cost of the funeral. In many cases, depending on how old you were when you started paying in and how old you were when you died, the payout may be worth less than what you’ve paid in.

When you buy an Aura funeral plan, we put your money aside in our secure, independently managed trust. The trust protects it from the potential impact of inflation and rising funeral costs, meaning you and your family will have peace of mind that everything is taken care of. This makes everything much easier for your family, particularly if they are struggling to cope with the death of a parent, or to deal with the unexpected death of a loved one.

Flexibility

With Aura, you can change your mind whenever you like. Amend – or even fully cancel – your funeral plan at any time, for any reason, and you’ll only pay extra if you are upgrading. When cancelling, you’ll receive a full refund of every penny you’ve paid us, meaning you can then transfer to another provider or method altogether as you wish. On the other hand, with a funeral insurance policy, if you miss even one premium payment – regardless of whether you’ve successfully paid in for decades – you may no longer be covered and the whole policy may be void; all the money you’ve paid up until that point is gone and can’t be refunded. The same goes for if you’d like to cancel your policy and move to a different provider.

Simplicity

When you have a funeral plan in place, your family can start the process simply by letting the plan provider know that the time has come. The provider will then arrange and pay for everything you’ve specified, without needing your loved ones to deal with paperwork or make difficult decisions during a painful time.If you’re relying on a life insurance policy instead, your family will need to contact the insurer and provide various documents before any money is paid out. The provider may ask to see the death certificate, confirm the cause of death, and collect other information before processing the claim.

Life insurance claims can take a few weeks to be processed and paid, even when everything is in order. This means your family might need to cover the cost of the funeral themselves in the meantime and wait for the policy to reimburse them later. Some insurers may offer a small advance to help with funeral expenses, but this is not guaranteed. In most cases, the full payout is only released once the claim has been reviewed and approved.

With a prepaid plan, the money is already set aside and ready to be used straight away. That means less paperwork, no waiting, and far less stress at a time when your family may be trying to cope with their grief.

| Aura prepaid funeral plan | Over-50s life insurance policy | |

|---|---|---|

| Guaranteed to cover your funeral expenses? | ✅ | ❌ |

| Purpose-built to pay for a funeral? | ✅ | ❌ |

| Can I get my money back if I change my mind? | ✅ | ❌ |

| Does the money I pay keep pace with potential inflation and rising funeral costs? | ✅ | ❌ |

After some high-profile industry turmoil in recent years, there are some people who doubt the security of prepaid funeral plans. Indeed, one of the first things people tend to ask Aura is “are funeral plans safe?”. Now that funeral-plan providers need to be fully authorised by the FCA, there are stringent requirements in place for the protection of your money. All of our plans are held in our secure, independently managed trust, and they are all protected by the FSCS, giving your money multiple layers of security. We were also proud award winners at the 2024 International Compliance Association (ICA) Awards, highlighting our exceptional processes to keep your money safe.

The good news is that, through our FCA-regulation, even in the highly unlikely scenario where we wouldn’t be able to deliver on your plan, thanks to our trust, we would be able to transfer your plan to another provider who is able, or issue you a full refund. As we say, this would be highly unlikely to be necessary, but it gives you peace of mind to know that there are provisions in place for every eventuality.

Much like with finding a life insurance provider, the best way to find the right funeral plan provider is to assess your options and see what’s out there. It will depend on the kind of funeral you’re looking for, and the kind of customer service you’d like your family to receive. Depending on whether you’d like a burial or a cremation, different things will be included in your plan; for instance, a funeral plan for a burial (or pre-need funeral insurance) very often doesn’t include the cost of expensive items like the headstone. Becoming more acquainted with the different options will help you to understand roughly how much funeral plans cost in general. Check to make sure the provider you’re interested in is authorised by searching the website of the FCA.

You can compare Aura funeral plans with other leading providers by viewing the table below, or by reading the linked article. Aura is the top-rated ‘Cremation Services’ provider in the UK on Trustpilot, with 4.9/5 stars. We are very proud of the recognition we’ve earned from the families who’ve entrusted themselves to our care, as it shows they’ve appreciated our compassionate and caring approach to funeral planning.

| Starting Price | £1,695 | £2,095 | £1,700 | £1,885 |

| Fairer Finance | ||||

| Trustpilot | 4.9/5 stars | 4.8/5 stars | 4.6/5 stars | 4.5/5 stars |

| All-Inclusive Pricingℹ | ||||

| Free Cancellation Anytimeℹ | ||||

| Money-Back Guaranteeℹ | ||||

| Aura Angel Support for Familiesℹ |

This comparison only includes direct cremation plans. Information is correct as of January 2026. Please note, Aura’s offering above is only applicable to plans paid in instalments up to 24 months. For those paying via 5-year instalments, different terms and conditions apply.

There are a couple of different ways that you can pay for your funeral besides relying on funeral insurance, like over-50’s life insurance. For instance, many people intend for their families to rely on their personal savings to pay their funeral costs, where others may turn to the government for assistance if they meet the eligibility criteria.

Some people plan to use their savings to cover funeral costs. But even if the money is there, it’s not always easy to access. Personal bank accounts are usually frozen after death, and it can take time for probate to release the funds.

One way around this is to set up a joint bank account with someone you trust, just for funeral expenses. Joint accounts typically stay open when one account holder dies, meaning the other person can access the money immediately. (This approach isn’t right for everyone and depends on trust, but it can help avoid delays.)

The government offers support for those who meet certain criteria. The Department for Work and Pensions (DWP) provides two schemes: the Bereavement Support Payment and the Funeral Expenses Payment. In some cases, your family may also be able to access funds from your bank or building society account to help cover funeral costs. Eligibility for these payments usually depends on your relationship to the person who has died and whether you’re already receiving certain benefits

In Scotland, the Funeral Support Payment is available through the Scottish government. Veterans may also be entitled to funeral support. You can check the UK government website for details. If someone dies with no money and no one to arrange a funeral, the local council can provide what’s called a Public Health Funeral. This is a simple cremation with no ceremony or choice in the arrangements. It’s sometimes referred to as a “pauper’s funeral.”

This option is a safety net, but because it’s so limited, most people would prefer to have plans in place to avoid it.

Planning your own funeral can be a complicated matter, but there are lots of avenues out there for support. From working with funeral directors, to non-profit or charitable organisations, and online comparison tools, there are lots of different ways out there to get informed.

Whether you’re looking to arrange a direct cremation or a fully attended, traditional burial with all the extras, funeral directors are there to help. Aura’s industry-leading Angel Team are experts in funeral arranging who can tailor their support to your specific needs. They understand that, for some people, the admin and paperwork is a welcome distraction from the emotional shock of losing someone, whereas others may want a little more support.

The Angels can offer as much or as little support with this as you’d like, leading you by the hand through the difficult experience of arranging a low-cost funeral. They can advise on what to do when someone dies, whether in hospital, a care home, or without a will. And they can even provide support with celebration-of-life planning, too.

There are charities and non-profit organisations out there that can sign-post to useful resources, and possibly contribute to the cost of a funeral. For instance, the Quaker Social Action charity can help to point you to funding opportunities, whether through the government or industry-specific charities.

There are also charities that can help with the grieving aspect of things. For instance, Sue Ryder has recommendations on things like joining local death cafes, which is a great way to learn how to talk about death and dying with others who are grieving near you.

More and more people are turning to online tools like crowdfunding and comparison sites to get more informed and to help them raise the money they need to pay rising funeral costs. Websites like JustGiving and GoFundMe can allow you to create a shareable link that you can distribute across your social media networks, perhaps whilst announcing a death to friends and family online.

If you’re looking to compare direct cremation providers, you can use consumer comparison websites to present all the relevant metrics and data in one place, which should help you to narrow down your funeral options.

We hope this article has been helpful for you, and helped you to understand what insurance covers funeral costs, as well as any other ways of covering funeral costs, such as our prepaid funeral plans. Of course, if it raises new questions for you, please feel free to give us a call; we’d be happy to help talk you through your options. Alternatively, why not download our funeral plan brochure for a bit more information?

If you’d like to know more about how to plan a cremation with Aura, our brochure is a helpful place to begin.

Our funeral plans are a helpful way to put everything in place for you or someone else.

When the time comes, our experienced team will be here to guide you through each step, offering support and advice whenever you need it.

To find out more about how our plans work, what’s included, and our story, you can request a brochure by clicking the link below. We will then send you a copy by email or First Class post—whichever you prefer.

The most common insurance products that can help cover funeral costs in the UK are:

Over-50s life insurance

Funeral cover insurance

Whole-of-life or term life insurance policies

These may provide a lump-sum payout upon death, which can be used to pay for some or all funeral expenses. However, they don’t always guarantee that the full cost will be covered.

Funeral insurance (like over-50s life cover) pays out a cash amount to a beneficiary when the person dies. The money can be used for any purpose but may not fully cover funeral expenses.

A prepaid funeral plan, on the other hand, guarantees that the funeral itself will be organised and paid for as specified—without the need for a family member to manage payouts or payments at the time.

It depends on your circumstances. While funeral insurance can help cover costs:

The payout might be less than you’ve paid in premiums

You’re not guaranteed full coverage for a funeral

If you miss a payment, your policy may be cancelled and your contributions lost

By contrast, a prepaid funeral plan guarantees coverage and protects against price inflation.

A funeral insurance payout may help cover:

Cremation or burial costs

Funeral director fees

Care of the person who has died

Transport to the funeral location

Some extras (flowers, limousines, celebrants), depending on the payout amount

However, many policies won’t fully cover all these items, especially if funeral prices rise significantly over time.

With over-50s life insurance, you must name a beneficiary—often your next of kin. This person will need to provide the Death Certificate and other documents to make a claim. The insurance provider then pays them directly, and they are responsible for covering the funeral.

Payout times vary by provider. Typically, insurers require:

The Death Certificate

Completed claim forms

Proof of identity of the beneficiary

The process can take a few days to several weeks, which may delay funeral arrangements if families are relying solely on insurance.

Prepaid funeral plans offer:

Guaranteed funeral coverage (no partial payouts)

Fixed prices at today’s rates

No admin for your family – the provider arranges everything

Refunds available if you change your mind

Protection by the Financial Services Compensation Scheme (FSCS)

They are often seen as more secure and straightforward than funeral insurance.

In most cases, you will lose the policy and all the money you’ve paid in. There is no refund. This is a major risk, especially for older people or those on fixed incomes. Prepaid funeral plans typically allow cancellation with a refund, offering more flexibility and peace of mind.

Yes—if purchased from an FCA-authorised provider like Aura. All prepaid funeral plans must now meet strict regulatory standards. Aura’s plans are:

Held in an independently managed trust

Protected by FSCS

Fully transferable or refundable if necessary

You can confirm a provider’s FCA status on the FCA Register

If the insurance payout falls short, your family must cover the difference—either out of pocket, via government support, or charitable help. This is why prepaid plans are often recommended: there’s no gap to fill.

Yes, but access to your savings can be delayed after death. Banks may require:

Probate

Death Certificate

Confirmation of next-of-kin or executor status

This can take weeks or even months. That’s why prepaid plans or insurance are often used for immediate costs.

Eligible families may apply for:

Funeral Expenses Payment (England, Wales, Northern Ireland)

Funeral Support Payment (Scotland)

Bereavement Support Payment (if a spouse or partner dies)

These are means-tested and may not cover the full cost, but can offer much-needed relief.

Yes. Many families use platforms like:

GoFundMe

JustGiving

These allow you to share a funding link with friends and family, especially when no insurance or funeral plan is in place. It’s a practical option during a time of crisis.